Online Retirement Calculator

Use this calculator to calculate the monthly amount required which you have to accumulate for your golden period of retirement.

Current Monthly Expenses

0.5K

20K

40K

60K

80K

1L

Current Age

Retirement Age

Life Expectancy

Inflation Rate (%)

0.5%

9%

17%

24%

32%

40%

Return Rate (%)

0.5%

6%

12%

18%

24%

30%

Retirement plans or pension plans are dedicated plans for one's retirement. The main idea behind having a dedicated plan like this is to get a fixed monthly income in the retirement days. Having a retirement plan has become indispensable nowadays because of the changing social values and rising inflation. Hence one should always have a dedicated fund or plan for retirement.

Various Options Available in India For Retirement

NPS

The national pension scheme is a pension scheme offered by Government of India which is available for subscription to all Indian citizens. The subscriber can make a contribution in Tier I and Tier II account. Tier I account is compulsory whereas Tier II account is optional. However, the contribution in Tier I account can be withdrawn only at retirement. Important point: - One has to compulsorily buy an annuity with 40% of the accumulated corpus in order to receive a pension which is taxable in the hands of the investor while the rest 60% can be withdrawn in a lump sum which is now tax-free.

Pension Plans Offered by Life Insurers

Nowadays most of the life insurers are offering pension plans which invest primarily in debt related instruments. However, it is advisable that one should have exposure to equity related instruments in order to create meaningful wealth over the long term.

These include:-

- Deferred annuity plans

- Immediate annuity plans

- With cover and without cover plans

Important points - In case of some pension plans which are offered by the insurers, the investor is allowed to withdraw only 1/3rd of the total amount on retirement while the rest 2/3rd amount will be utilized for providing a pension.

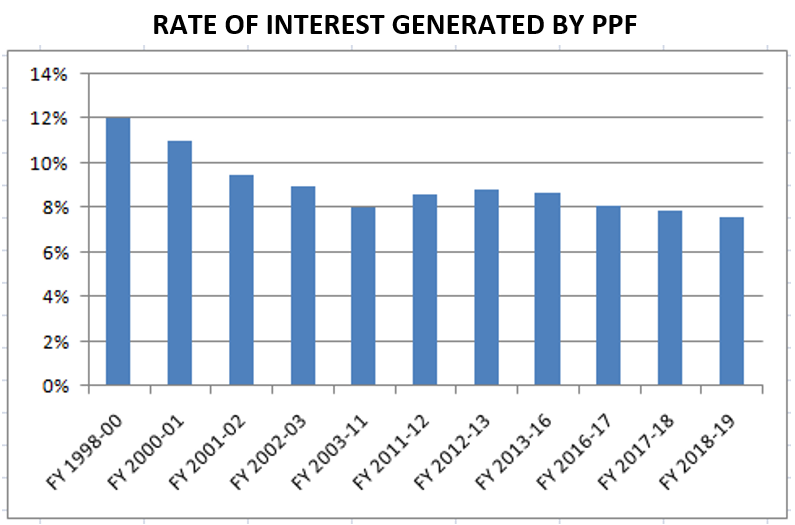

PPF

PPF or public provident fund is a small saving scheme which is open for subscription to all Indian citizens. PPF is the most preferred choice among Indians since it enjoys EEE tax status. However one must not forget that it comes with a lock-in period of 15 years and also the returns it provides are also not sufficient for one's retirement. Moreover, the returns are in a downward trend. Below is the overview of it:-

What Should Be The Right Approach?

Since the above-mentioned pension plans suffer from some kind of disadvantages one should opt a different strategy which should provide liquidity, superior returns, and should also be tax-friendly.For the individuals in the age, bracket say:-

- 30-40 years - They must put 70% of the investible surplus in mid-cap funds while the rest 30% in large-cap funds

- 40-50 years - They should invest 30% in midcap funds and the rest 70% in large caps funds.

- 50-60 years - They can invest 50% in large-cap funds and 50% in hybrid equity-oriented funds.

- Above 60 years - They can put the entire accumulated corpus in an equity-oriented hybrid mutual fund and can start SWP in order to receive a monthly pension

SWP or systematic withdrawal plan is the strategy which automatically withdraws a specified amount of money every month into the investor's bank account from the specified mutual fund scheme.

Hence an investor will be better off by adopting this kind of strategy as he would be earning better returns along with saving tax outgo.

For example, an individual requires a sum of Rs 50000 every month and he is in the highest tax bracket then his tax outgo in case of pension products and the above-mentioned SWP strategy will be:-

- Pension products - Tax is to pay @30%.

- SWP strategy - Tax is to pay @10% on capital gains of over Rs 1 lac.

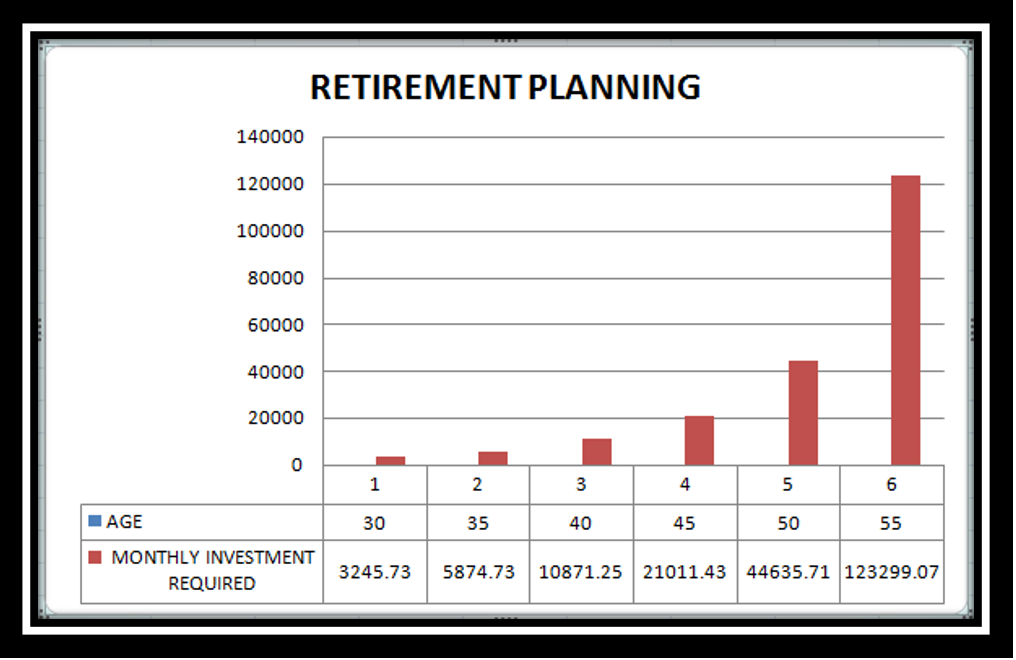

Benefits of Starting Investment

Early One may not be aware but there are lots of advantages for investing early. Have you ever heard about the eighth wonder of the world? Well, it is not any monument but the power of compounding. One may not have any idea what wonders compounding can do to their investments.

Look at the above figure wherein we have calculated the amount which an investor is required to invest on a monthly basis in order to receive a sum of Rs 1 crore at the age of 60 years.

If you take a closer look at the figure then you will find that if you start investing at the age of 30 years then you just need to invest Rs 3245 p.m. while if you delayed investing for your retirement by say only 10 years then this monthly amount will shoot up to Rs 10871 p.m. and if delayed by another 10 years then it will go beyond Rs 40000.

Most of the people argue that they do not have the required amount at present for investing and hence will invest when they will have that required sum.

However, they do not realize that by delaying investments one is only bringing trouble for himself. The ideal strategy is to invest as early as possible with the entire surplus amount you have at present.

Further Reading: